Marketing automation is a powerful tool to assist a US credit union industry that faces numerous challenges. On the one hand, the percentage of the US population that is served by credit unions has increased from 33% of the total in 2007 to 43.7% of the population which is a figure equivalent to 100 million members. But this growth in membership has made it more difficult to communicate productively with users. Consequently, there is a need for marketing professionals to leverage best-in-class technology to assist them in serving their clients and acquiring new ones. Fortunately, marketing automation innovator Experiture with its Human Engagement Platform is well-equipped to address the challenges confronting the credit union industry.

Marketing Automation: A Tool to Reinforce Credit Unions’ Advantages

Credit unions’ central advantage is their community knowledge and commitment to responsible lending on behalf of members. This has positioned them to avoid the excesses of the financial crisis while maintaining strong asset quality. But for the 20% of credit unions with assets in excess of $100 million and/or more than 25,000 members this is not so easy. As Jill Nowacki, VP of Development for the award-winning Maps Credit Union in Salem, Oregon has noted: “We’re community-chartered, and it’s our responsibility to reach all niches with our products and services.” As noted by Ms. Nowacki, it is imperative for credit union marketing professionals to know their audience and what’s happening in their communities but the larger they become the harder that is. Furthermore, new member recruitment, existing member engagement and the product innovation that results from it is becoming much more difficult for credit unions due to the rapidity of technological change and the challenges intrinsic to reaching and retaining highly prized demographic groups such as the 20 and 30-something Millennials who are intensive users of mobile and social media.

Expertiture’s marketing automation tools can help by enabling credit union professionals to reach each one of their unique customers. Lead nurturing is facilitated in that time-consuming manual lead connection is no longer required because our automated solutions make it possible to reach out to potential leads immediately from the beginning of interactions. Experiture’s robust suite of lead nurturing capabilities include an easy interface for sending automated e-mail marketing; triggered e-mails that can respond with relevant information when prospects interact with marketing materials; deep CRM integrations that pull prospects into programs and return their engagement history and other information into each individual record; lead scoring that helps sales teams focus on the most purchase ready prospects; and robust ROI reporting on the effectiveness of lead generation efforts.

Growing Competitive Pressures

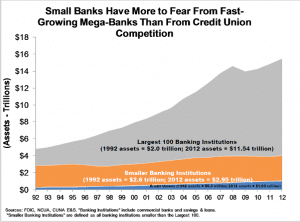

Credit unions face growing competition. As of March 2015, credit unions assets are $1.17 trillion which is 5.5% growth from March 2014. Nonetheless, credit union assets are miniscule in comparison to those of the 100 largest banking institutions in the country:

With only a little over $1 trillion in assets, credit unions hold 1/14th of the assets of the top $14.5 trillion held by the top US banks. Indeed each of the country’s four largest banks is larger than the entire credit union industry and the average bank is fourteen times larger than the average credit union ($2 billion vs. $150 million in assets). Only 20% of credit unions have more than $100 million in total assets while 67% of banks are this large. This enormous difference in scale and resources looms as a massive competitive challenge for both small banks and credit unions:

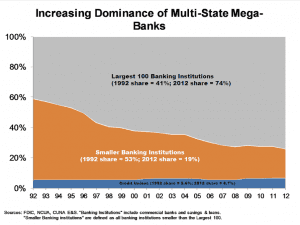

Over the last 20+ years, the market share of the large banks has increased by over 75% while the smaller banks have experienced a steep decline of 60%. Amongst small financial institutions only the credit unions have held their own with a 20% gain in market share during this period. Why?

Credit unions have survived in the face of intense competition from large banking institutions because they are local, community actors with a special responsibility to their members not to be reckless in their lending. While the asset quality of larger banks has declined due to the risky practices such as sub-prime loans, liar loans and toxic mortgages that created the financial crisis and engendered subsequent federal bailouts, the asset quality of credit unions has remained high. Credit unions are portfolio lenders who are owned by their borrowers and the loans that they originate tend to be traditional, conforming—and much safer loans. Experiture can help credit unions maintain and deepen engagement with members by personalizing marketing interactions.

IT Departments Are Overwhelmed

A related consequence of credit unions having fewer resources is that they typically have small IT departments that lack cutting edge capabilities and not surprisingly they have been slow to adopt innovative marketing technologies. Unlike the larger financial institutions, credit unions typically don’t have a lot to spend on IT and not many credit unions have e-mail addresses for their members so the ability to use both traditional direct mail marketing techniques in tandem with novel multichannel marketing and social media technologies is imperative. For example, according to Jan Simon, Executive Creative Director and President of Simon + Associates Advertising:

Many credit unions rushed to social media, but the strategy on how to leverage the medium was never thought out. Everybody has a huge interest in adding online/digital components and social media to their existing marketing campaign goals. The biggest hurdles we are seeing are the lack of understanding, which leads, therefore, to a lack of planning and the lack of budgeting to effectively venture into that space.

Marketing automation can be a powerful tool to overcome these challenges. It is an enormous time saver as one can create multiple marketing campaigns and posts ahead of time and schedule them for a specific time and date in the future. It also makes it possible to maximize the use of scarce personnel resources as an individual staff member can execute complex campaigns and connect with far more customers than is possible manually. That technically competent personnel are even scarcer and more expensive further enhances the impact of marketing automation as the technology does not require any programming or design experience to be utilized effectively. The big payoff is financial as marketing automation saves the credit union money since it dramatically reduces the need for staff to spend their valuable time and effort collecting data, creating messages and then distributing them. They are free to focus on the strategic issues critical to competitiveness.

Experiture’s Customer Experience Marketing Platform is incredibly simple. By using a simple drag-and-drop Program Designer, a single user can easily create automated, multi-step marketing programs across the Internet, mobile, social, email and direct mail; and then view the results of each channel within various marketing programs so as to assess the impact of each channel.

Regulatory Challenges

That credit unions must adhere to regulations that require them to send a compliance membership package to new members via direct mail enhances the challenge they are confronted with. Given these challenges, there is strong demand for a low cost, low hassle marketing automation solution that can be outsourced to an external vendor. Just as financial services have been revolutionized by information technology and Big Data, the marketing technology field is in the midst of a similar renaissance that is equipping the Davids of the credit union industry to combat the competitive threats posed by the Goliaths of the banking industry. Marketing technology can accentuate the deep community engagement and product innovation capabilities that are what credit unions do best so that they overcome the powerful but less nimble megabanks with highly customized and precisely targeted services delivered to their members across multiple marketing channels.

In regulatory matters, consistency is essential and that is a salient advantage of marketing automation. Posts can be scheduled far in advanced and adjusted immediately in response to new information; and the feedback analyzed with detailed reports. Human engagement increases but human error decreases.

Experiture’s Multichannel Personalization allows users to automatically and precisely engage customers at a deep level by presenting personalized online or mobile content, messaging or offers based on a customer’s profile information (age, location, behaviors, interactions, etc.). The information gathered can be robustly analyzed using Experiture’s Sales Automation Dashboard to demonstrate the effectiveness—or lack thereof–of every channel in the customer’s experience marketing program. Tools in the Sales Automation Dashboard include: a “hottest records” screen that calls out the readiest, most interested leads and promising opportunities; the ability to easily identify customers with ‘flame’ icons that denote sales-readiness and lead quality; and the capacity to turn insights into action by enrolling records in one-off emails or ongoing nurturing programs directly from within the CRM.

Most importantly, by providing critical data points about the consumer and enabling intelligent customer engagement, marketing technology has become a critical tool for branding. More than ever, beyond price and sometimes even quality, branding—the development of an emotional connection with the consumer, has become the most salient and enduring competitive advantage for a firm. Marketing automation makes it possible for any business of any size to create a consistent brand presence on multiple marketing channels. This is essential as maintaining a consistent brand makes it easier for customers to identify your business in a fragmented, competitive marketplace and connect with you in the way that is most convenient for them while increasing your visibility to new potential customers. The data that is gathered from these interactions can be used to create detailed customer profiles that are being updated at a far faster rate than manually since an automated solution is always gathering and integrating information based on customers’ purchases, e-mails that are opened and responded to, etc.

A central branding tool of Experiture is its Centralized Marketing Data Warehouse that aggregates information about your customers from multiple, disparate sources—your CRM, point-of-sales, ecommerce software, etc.–into a single system of record. This centralized data which includes contact information, demographics, transactional interactions, and behavioral patterns can be analyzed to provide the Big Data that catalyzes branding through segmentation, personalization, and intelligent targeting of marketing resources.

To see what Experiture can do for you, visit https://experiture.com or call 888-950-0700.