“You never get a second chance to make a first impression.” This basic maxim elucidates why it is so critical to have a great new member welcome program. Experiture with its unique suite of personalized e-mail and direct mail capabilities can be a critical part of your onboarding strategy.

The Importance of Onboarding

Having a strong new member welcome program is essential because welcome e-mails introduce subscribers to your brand and are also very effective tools in terms of open, click, and transaction rates. For example, welcome e-mails see more than 3x the transactions and revenue per e-mail over regular promotional mailings:

In addition, subscribers receiving welcome e-mails are self-selecting, which means that they have declared a direct interest in your brand and are interested in communicating with you. E-mails are critical for effective onboarding because they can be generated centrally, personalized within minutes of opening and account, and deployed rapidly and with the ability to provide an embedded link to a personalized url. These are all capabilities that Experiture provides with the added benefit of being able to coordinate across multiple marketing channels including direct mail.

Never Forget to Say Thank You

A simple “Thank You” is a powerful means of creating increased brand value by locking in your customer at the moment when they are just beginning to learn about you and how you to do business. While promotional and informational e-mails perform well, the graphs below demonstrate that “Thanks for Joining” messages drive the highest transaction rates as well as revenue per e-mail:

Experiture’s auto-response capability can send respondents a single “Thank You” message or a multi-step, multi-step, multi-channel lead nurturing program based on responses given.

Communicate Early and Often

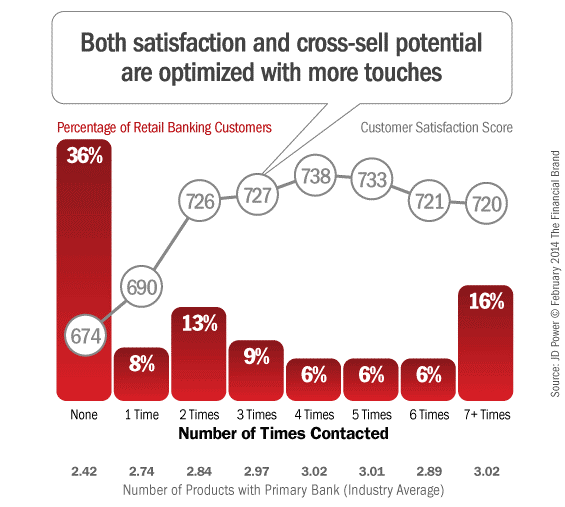

By communicating with the customer early and often after they open their account, you are much more likely to foster a positive customer experience, differentiate your institution and build long lasting customer loyalty. For example, one of the biggest mistakes that financial institutions make in their onboarding process is to have only a couple of “touches” during the first 60-90 days. Rather, according to JD Power & Associates, customer satisfaction and cross-selling success both improve as the number of contacts is increased up to 4 times and is actually still effective if the customer is communicated with as many as 7 times during the first 90 days:

Furthermore, for financial institutions, instead of moving too fast to cross-sell, the majority of early communication should focus on logical “go with” services such as direct deposit, bill pay, alert notification selection, and online and mobile banking. As part of this process, Experiture’s automated marketing tools can precisely and effectively communicate in a highly personalized manner with new members at designated intervals across multiple marketing channels including direct mail, e-mail and social media.

Test, Learn and Measure

The return on investment from onboarding programs is always positive and many times has a return of 5:1, 10:1 and even 20:1 but personalization is critical because there is no “one size fits all” onboarding program for every financial institution. Product sets differ as do new account opening processes so it is important to test, learn and measure results for maximum effectiveness as part of an iterative process. Experiture’s multichannel analytics and reporting tools help measure marketing results and tailor your messages to specific customers in your database by providing a single on-demand interface to access your key multi-channel metrics. Specifically, you can isolate and view the performance of your individual e-mails, landing pages and more within Experiture’s intuitive and easy-to-use reporting and analytics graphical interface that allows you to see opens, bounces, unsubscribes, clicks, visits, responses and more.